Things every founder should know about "founder's stock" and QSBS

A few things to think about before you sign the charter or a secondary or exit opportunity comes up

Nota bene/disclaimer: I am not a CPA nor a tax or corporate attorney, just a founder who has learned a lot through trial and error.

I can’t speak for other founder’s experience, but when I founded my first start up it was rather abrupt: I was already drinking from a firehose on so many fronts, I barely paid attention to the alphabet soup of new numbers and letters the attorneys and accountants threw at me while I was signing paperwork - then writing a small check to buy my stock. It turned out that some crucial tax harbor provisions were hidden in these initial steps of formation and I’m glad I diligently did what I was told (and have a few more times since).

My hope with this post is to explain in layman’s terms some of the crucial nuances of how start up stock is fundamentally different- and taxed differently - that are relevant to someone who finds themselves in a similar position to where I was.

Hopefully after you read this you will be able to plan, rather than react, or have to pay expensive tax attorneys or CPAs at $400-500/hr to educate you (or in one case of a CPA who really didn’t understand it either, I had to pay to educate them) while watching a stop clock from the IRS. The intent here is to help arm you with the right questions to ask your expensive counsel rather than fumbling around in the regulatory dark.

Why is practically every start up (that gets funded) a Delaware C-corp?

First off, I’ve had a lot of friends who got themselves in trouble by forming an LLC to to contain their start up work legally and then bootstrapping a good deal of money and time into said start up idea before pursuing start up funding. The reasons cited are usually the legal simplicity of forming an LLC (it costs maybe $300 on Legalzoom) and the fact that they don’t want to divide up the equity yet (a C corp requires you to do this near inception because the number of shares is set in the initial charter; an LLC gives you much more flexibility on how many units of stock you initially deploy).

You can read more about the pluses and minuses of both here, but the key thing for you as a start up founder if that almost all venture and angel investors in the tech space will only invest in you if you are at a minimum a C-corp and even more strongly preferred a Delaware C-corp.

The Delaware part is explained by the fact that they a) have no corporate income tax for companies not doing business in DE but registered there; and b) You can quickly file here (same day filings and charter updates with a fee); c) Delaware Chancery court is the most effective in the country since it specializes in corporate law and is known for it’s speed, pragmatism, efficiency and massive amount of case law dealing with both venture backed and publicly traded corporations. You can read more about the reasons here.

The C-corp is because it makes it easily investible because the number of shares created is finite and a board exists for governance and oversight. By virtue of being a C-corp focused on R&D, investments in it are also subject to a part of the tax code called section 1202 which gives huge tax advantages to incubating and investing in high risk early stage R&D companies. For early stage companies, this creates a huge tax advantage that I will discuss in more detail below.

If you aren’t a Delaware C-corp and you want to get venture funding, you will almost certainly have to go through the process of converting your LLC to a C-corp, which almost certainly has tax implications and is a big headache you can read more about here that can cost you thousands in legal fees and a lot of wasted time.

What is “Founders Stock”?

Founder’s stock is kind of a misnomer you’ll hear lots of people throw around. I’ve actually had prospective advisors and investors during a seed round ask me for “founder’s stock” only for me to have to tell them that the ship had sailed for this and it was no longer possible.

Founder’s stock is a overused term for stock purchased by the founder’s at formation (whose shares are specifically enumerated in the founding documents like the articles of incorporation) at a de minimus value (often $0.000001 per share), with all initial founders paying maybe $100 TOTAL for their stock. This is because when initially formed, for appraisal purposes, the company is a shell company with no assets and effectively worthless.

What’s so powerful about this is two things: a) you file an 83(b) election which means that effectively you are paying your taxes up front (more on this later); b) your vesting clock starts immediately and for tax purposes, your five year clock for QSBS starts immediately. This is so powerful because the first $10 million in capital gains on QSBS stock is sheltered from capital gains taxes.

So later on when other executives join, they will have to wait until they fall off their cliffs and have the funds to exercise for their QSBS clock to start; yours starts immediately and that’s incredibly powerful advantage that changes founder’s incentives vs other early stage employees. When the company is actually financed, the VCs backing you will generally revised your share purchase agreement so that if you leave the company early, they claw-back your stock for the remainder of the time you didn’t vest. So effectively, any stock not clawed back you own free and clear.

It should be noted that this is for common stock only. If you are investing your own money, that’s preferred and a different set of rules apply.

An interesting loophole for founders stock in pre-seed round companies

While there are lots of varying definitions of pre-seed vs seed round financings, how I generally draw the line is between a priced round (where shares are actually distributed and an option pool for employees is created) and a debt round where the company just raises money to get started without any preferred stack. If you’re priced, it’s a seed round; If you’re raising on a SAFE or a convertible note, it’s a pre-seed round.

With the growing popularity of SAFEs as the most common form of early financing due to how cheap and easy they are to do (maybe a few thousand in legal fees as opposed to a seed round that can run $30k or more), an interesting loophole exists which allows one to effectively extend the benefits of Founder’s stock to a few early employees.

In a pre-seed company without an option pool, the only way to award stock is through Restricted Stock Units, or RSUs. Since there is no appraised value beyond the initial creation event (ie a 409a), these shares can be purchased for the same de minimus amounts the founders paid ($0.000001 or thereabouts) and the early employees and advisors can file an 83(b) and enjoy the same tax benefits as the founders. This is a huge hack for founder’s doing early recruiting and a perq to joining an early company that can really help you attract topshelf talent and I’ve seen several pre-seed founders use this to their maximum advantage.

There is a narrow window in which this is actually the case without violating some safe harbor rules on appraisals (check with your tax lawyer on this) but typically within the first few months of the company and pre-revenue, it’s safe to do this.

Your 83(b) elections?

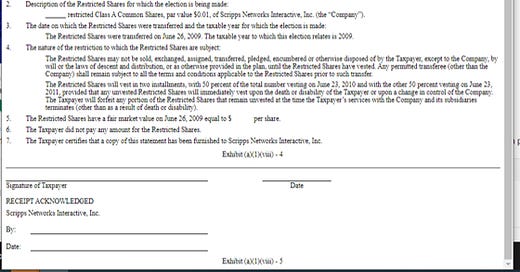

For serial founders, 83(b) elections are always a fun time This is a form that looks like this:

This form is intended to inform the IRS of your intention to pay your taxes upfront for the de minimus amount you paid for your founder’s stock and begin your QSBS clock. By doing this, you effectively shield any gains on your stock up to $10M after 5 years from taxes. You need to do this within 30 days of filing the paperwork and buying the stock. I’ve heard of richer investors also doing this for actual investments, for other reasons (ask your lawyer if you’re in this situation).

When you mail this, you are going to want to send it certified mail and include a note kindly asking them to stamp and certify your autographed copy so you know it went through. If your company gets big and you have an exit, this could save you millions so make sure you do it right.

You’ll also want to write a physical check (remember those things?) that memorializes that you actually paid the money to the company as well. A very enterprising founder used to be able to write this out of their self-directed IRA to completely shield themselves from taxes (Peter Thiel’s multi-billion dollar Roth IRA famously did this), but I believe this loophole may have been eliminated in recent tax legislation.

The QSBS stop clock

If you hold a QSBS qualified stock for at least 5 years, it’s eligible for exemption for the first 10 million dollars in gains or ten times the adjusted capital gains, whichever is greater. Not all states honor QSBS but the 15-20% federal capital gains rate is exempt up to these amounts and in high tax states this can mean the difference between paying 17.8% and paying 42% (Obamacare taxes still apply) on the fruit’s of your life’s work.

An important nuance here with respect to employee stock options: RSUs (including “founder’s stock”) begin this vesting immediately, whereas ISOs/NSOs only start the clock when you exercise your options. Many experienced advisors and employees will take advantage of “pre-exercising” options (basically paying up front the full amount at the strike price) if it’s available - often Carta will be able to tell you this - this is particularly important for NSOs where the basis in 409a valuation can create a taxable event just for exercising your stock. This is particularly advantageous if the company has an exit through acquisition, selling into an employee IPO block, or a secondary sale opportunity arises, in which case the stock sale may be taxed as short term capital gains (ie regular income) if the exercise occurred within 12 months of sale.

Another important nuance: when companies get big enough (over $50M in total assets), future option grants will lose their QSBS exemption, so it’s important to keep track of which option tranches this applies to if you are employed by a company that is lucky enough to punch through this threshold. It can also be an important nuance to remember when deciding how much cash to take in during a fundraising round - be mindful you aren’t blowing up your QSBS status in early stage by taking in too much money! This can be an important carrot to offer prospective hires that you can’t get back once you lose it.

Rolling over QSBS gains

What makes QSBS so powerful isn’t just the $10 million dollar/10x exemption: it’s the facts that QSBS eligible stock gains can be rolled over into stock for other QSBS start ups (1045 exchanges) as well as a relatively new category Qualified Opportunity Zone Investments (QOZ) which are almost entirely real estate. Within the appropriate time windows you can use these to diversify out of concentrated positions into others and opportunistically angel invest at a discount.

I’ll touch on each of these below.

1045 exchanges (rollovers)

When you sell QSBS qualified stock and then purchase other QSBS qualified stock within 60 days of sale (that means share purchase agreement signed, check or wire dated) the step up basis is exempt from federal capital gains in a rollover known as a 1045 exchange. This is the start up equivalent of the famous 1031 exchange rule that many folks use for diversifying and trading in and out of apartment buildings and commercial real estate. Again, you may still be subject to state or local taxes depending on jurisdiction.

1045 exchanges work for any QSBS stock you’ve held for a six months or more. This can also be daisy chained (keep rolling into other deals as long as you wait the prerequisite six month window). While there is some controversy as to whether or not this needs to be for priced stock, as opposed to a debt instrument like a note or a SAFE, I have had some people tell me that it’s passed audit scrutiny (again, check with your tax counsel before doing anything I say here).

Many founders will use this rule for it’s intended purpose: to take equity out of their last company and sell it to start their next one. That way they are effectively playing with free money (since they probably paid around $10-$20 for the stock in the first place). Another nice benefit is that the QSBS clock can keep going from the original investment.

It works for angel investors too: when I first got in the start up game, I always wondered why even in Series A and beyond rounds (which can be pretty expensive for angel checks) I would see a boatload of angels/individuals on the cap table with sizable ($25k) checks and this is partly why: they are playing with windfall money from exits and secondaries in other start ups and they need to quickly deploy to keep the chips on the board, keep the clock going and manage their taxes.

You have to be careful here to still run diligence on these investments even if there is pressure to “use it or lose it” before the 1045 exchange window expires, but nonetheless this can be another crucial instrument for bringing down your tax bill and multiplying your returns.

QOZ investments

Let’s say you can’t find any other start ups worth investing in within 60 days of a secondary sale, is there anything else you can do? It turns out that the 2017 tax reform law created a class of investments called Qualified Opportunity Zone (QOZ) investments that have a 180 day investment window and can even extend into another tax year. This is longer in recognition of the long escrow processes often associated with real estate transactions.

Opportunity zones are specific census tracts which have been identified as economically disadvantaged. The tax reform bill created a system of incentives to encourage investment here and Qualified Opportunity Funds (QOF) are the mechanism to do this. While there are a lot of nuances tax wise to these vehicles that Fidelity does a good job of summarizing here, the big one is the step up in cost basis. If you hold your investment there for 10 years or more, you receive a step up in cost basis on your capital gains to the new amount. So in other words, if you roll in gains of $10 million into a QOF and hold it there for ten years, the first $10M is effectively shielded from taxes (any gains since will be taxable, however). This is great if it’s money you aren’t going to spend right away and you can invest it in a fund that will pay you distributions. Just beware that you’ll probably get cash called for a couple years while they are doing construction and trying to get the properties leased, so be prepared for that up front.

Conclusion

Most of us didn’t go into tech or business to become tax experts, but the prospect of giving over half of whatever we earn from years of killing ourselves to make something great can force you to quickly become one. Having a solid understanding of the QSBS landscape and the various tools in the tax code you can use to maximize the gains you keep for yourself is an important muscle every entrepreneur should develop. I hope this overview can help other entrepreneurs navigate this landscape a little bit better and at least arm them with the right questions to ask of the professionals.