Why Buy The Milk When You Can Get the Cow for Almost Free?

Thoughts on Amazon and Microsoft's Hire away, not Acquihire, Strategy in AGI

This will be a quick post due to the 4th of July last week plus increasing constraints on my time as I’ve been busy working on a new project (more on this will be revealed soon)

NB: I have only one direct AGI investment (Procurement Sciences) and I’m an LP in an early stage fund, Zelda Ventures, which does a lot of AI investments. I am not an expert in AGI nor LLMs, merely a weekend athlete.

In Case You Missed It

It would have been easy to miss the news in the midst of the mid-week 4th of July that Amazon had hired away almost the entire team of AI agent start up Adept, including the CEO, rather than acquire the company. This seems like a borderline shitty deal for the preferred shareholders, who put $400M+ into building AI agent tools with this team for the last 2 1/2 years, including Greylock, Spark, Microsoft and General Catalyst. This is especially so when you consider that the company will only get the consolation prize of a licensing deal that probably includes all sorts of exclusivity provisions with Amazon for disemboweling its talent and founders.

In this respect, Amazon did to Microsoft what Microsoft already did to AI Chatbot company Inflection AI a few months ago…after it had raised $1.5B!

Microsoft did this exact same play a few months before, poaching the co-founders and paying $650M in licensing as a consolation prize (as opposed just buying the company like they used to do). Supposedly the investors made 1.5x their money in this case, which is pretty disappointing for a late stage return that they likely hoped for a 3x or even 10x (or more) return on.

Even more interesting, Reid Hoffman was involved in both of these investments through Greylock ventures. Kind of bad luck that he got caught up in the same poach & license trap for late stage investors twice in less than four months, isn’t it?

So what the heck is really going on here?

Regulatory Constipation in the M&A market

The most obvious theory I’ve heard here is that this is a very rational attempt to avoid the FTC weighing in and blocking high profile mergers by big tech companies, something that has become a nearly daily occurrence under the Biden administration. Chairwoman Lina Khan (shown below) has been extremely aggressive in blocking mergers and acquisitions, no matter how dubious the case for them impacting competition and especially for tech companies.

Chairwoman Lina Khan has been extremely aggressive in blocking mergers and acquisitions, no matter how dubious the case, and especially for tech companies.

Some noteworthy examples of this include NVIDIA’s blocked acquisition of ARM Holdings, Adobe’s blocked acquisition of Figma, FTC’s attempted block of Meta’s acquisition of Within, The failed attempt to block Microsoft’s purchase of Blizzard/Activision and of course the quixotic blockage of Amazon’s acquisition of iRobot, who makes the Roomba. Each of these failed (and even the successful) deals come with tens to hundreds of millions in legal costs not to mention there are usually discharge penalties in the hundreds of millions written into cancelling the deal.

This regulatory action have severely reduced the number of attempted exits by discouraging tech companies and others with aging portfolios to buy new products or features like they have in days of yore (certainly not at the same pace).

Big Tech vs Little Tech and the Battle for AGI Market Share

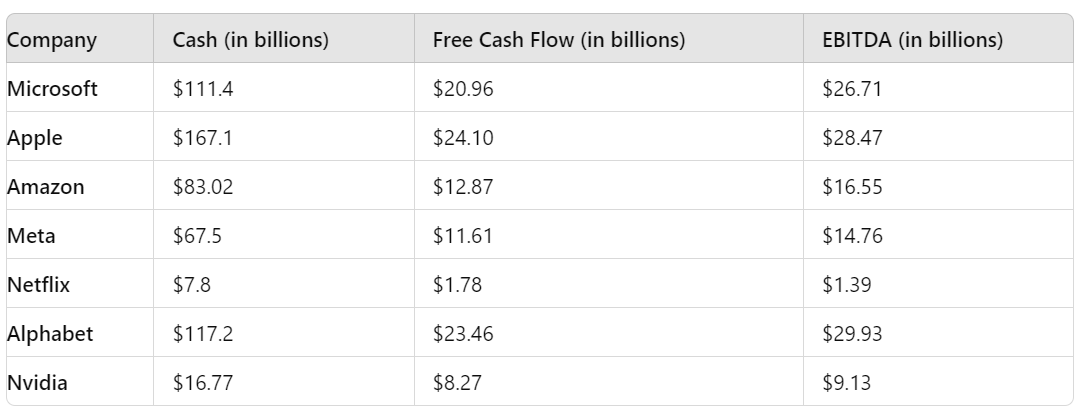

It’s fairly common knowledge that the FAANGs, Microsoft and NVIDIA have more cash sitting on their books than many sovereign wealth funds (see Table 1 below). These companies are eager to expand and are spending billions on AGI infrastructure, buying tens of thousands of AGI processors and investing in the software, data centers and even power to run these enormous LLM models. What they are often lacking is features to integrate into their existing product lines to differentiate and allow them to upcharge their customers.

So if you are sitting on a ton of cash, get taxed for stock buybacks, don’t want to start paying a dividend and have most paths to acquisition blocked, what do you do? Get creative, that’s what!

When it comes to AI, Acquihire is the new Acquihire

By doing a non-acquihire acquihire, you skirt by the M&A scrutiny of the FTC (or so the thinking goes). But Microsoft and Amazon are effectively hollowing out the assets of a tech company - grabbing its talent and a license for its IP - while leaving the corporate husk of what remains for the preferred investors. This approach isn’t without risks: preferred shareholders in general don’t like getting screwed like this shortly after making an investment and there is a non-zero chance some of them will sue you for unfair competition or other prospective claims. But caught between civil litigation which can be paid off at a negotiated rate in arbitration or a blocked deal with hundreds of millions or billions in unwind penalties after years of prospective litigation weighing on your stock price, take your pick.

The Founders Dilemma and Late Stage Companies

So why would a founder, who owns 5-20% of a company valued at billions of dollars, choose to join a Microsoft or Amazon, stop vesting and abandon their company - and potentially burn a bridge with well heeled investors in the process? What do they know that we don’t?

First off, savvy founders know that valuations are not as simple as they appear on paper. Preferred shareholders have acquisition rights that put them ahead of common shareholders if the company sells for less than the last valuation. If you raise $1.5B like Inflection AI did, the company has to almost certainly clear the “preferred hurdle” of $1.5 billion before common gets a dime, and that’s assuming pretty vanilla pari passu 1x liquidation pref type of terms that are not always a guarantee as valuations climb. So, as valuations get larger and larger and more and more cash piles up in the preference stack, there is a strong possibility that common stock won’t amount to very much.

So if you are a founder, do you take the bird in hand of millions of dollars in cash salary and a stock plan plus a cushy job at Microsoft or Amazon, or keep rolling the dice when you know you don’t have a clear path to exit and you are in a crowded field with minimal moat?

The current FTC-induced constipated acquisition environment is weighing on potential valuations for these AGI companies- founders and their early employees know it. The companies meanwhile are free to take the cash from the licensing agreement and continue to shoot for another shot on goal, take it out as dividends and wind down the cash position of preferred after a lengthy period of time.

We don’t understand the details of these new employment agreements for the founders and the teams they bring with them, but it’s highly likely that they include salaries in the millions and very lucrative stock and stock option packages.

So if you are a founder or one of their chosen few early employees, do you take the bird in hand and millions of dollars in cash and stock plus a cushy job at Microsoft or Amazon, or keep rolling the dice when you know if there is a clear path to exit and you are in a crowded field with minimal moat?

Meanwhile, later stage investors are starting to get smart on this “gut and license in lieu of acquire” strategy. I’ve heard reports that many term sheets for later stage AI and chip companies are putting anti-poaching clauses in there that come with teeth/penalties if the founding team is somehow lured away. How this will play out in states like CA with very liberal right to work laws remains to be seen, however.

***

I’ll be keeping an eye on this as it develops and will revisit at a later date. It’s possible a different administration that is less aggressive about anti-trust enforcement for big tech may make this practice a historical blip rather than a trend, however.

Memes are so good